Introducing Single Stock Spotlights (SSS) - #1 Celanese

Highlighting Celanese as our first SSS writeup - chemical producer with 100%+ upside and multiple near-term catalysts

Like many things in the age of the Internet and AI, investment research has been democratized and diluted.

There are thousands of blogs, Twitter accounts, Youtube channels, and Substacks dedicated to stocks, with no end of articles, podcasts, and publications for retail investors to consume.

Given this reality, I had to think really hard about what differentiated value Hidden Rock Capital can provide in this saturated space.

What I have noticed is that while there is no shortage of pontification and observations about various stocks and businesses, the authors often struggle to clearly and concisely explain how and why a particular stock can make you money!

A sentence should contain no unnecessary words, a paragraph no unnecessary sentences, for the same reason that a drawing should have no unnecessary lines and a machine no unnecessary parts.

-The Elements of Style (William Strunk)

As someone who lived and breathed stocks & markets for many years (working as both a sell-side and buy-side investment analyst) I understand better than most what matters in stocks making money for investors.

Let me share what those 4 things are to make you money:

WHAT: What should the stock be worth vs. what it’s trading for today?

WHY: Why is the market mis-pricing the stock, and what is the “variant perception” that the market is missing?

HOW: How will this valuation gap be closed? What are the catalysts that can close this gap and prove your variant perception to be true?

WHEN: A cheap stock can get cheaper. It needs catalysts (see point #3) as well as incoming fund flows to reverse the downward momentum. Technical analysis can visually show momentum reversal and cue that the stock is ready to go higher

Sounds simple in theory right?

I will be launching new series on “Single Stock Spotlights” where I apply this blueprint to highlight specific stocks I think can make money for investors.

These writeups will not be 100 page essays on the company’s history, operating segments, and everything under the Sun.

99% of this information does not matter in the stock making money for investors!

Instead I will hone in on the WHAT, WHY, HOW, and WHEN the stock can make us money, which is probably what most of my readers care about.

With the background now set, let’s jump into our very first SSS on Celanese (CE), an undervalued chemical producer that I believe can double from its current price.

1. What is Celanese Worth?

Chemicals as a sector has been in deep doo doo for the past few years due to both low demand (due to high interest rates and slower GDP growth) and excess capacity, largely from China.

Celanese compounded these woes by making an expensive acquisition just before the recent industry crash. CE purchased Dupont’s Mobility & Materials (M&M) business for $11B in 2022, which top-ticked the cycle in retrospect and caused the firm’s debt levels to reach uncomfortable levels for investors.

As a result of these industry and company-specific misshaps, Celanese stock has plunged by over 60% in the past 5 years.

Source: Seeking Alpha

So what is Celanese worth?

This is what Celanese’s adjusted earnings per share have looked like during the past 10 years:

2016 = $6.61

2017 = $7.51

2018 = $11.00

2019 = $9.53

2020 = $7.64

2021 = $18.12

2022 = $15.88

2023 = $8.92

2024 =$8.37

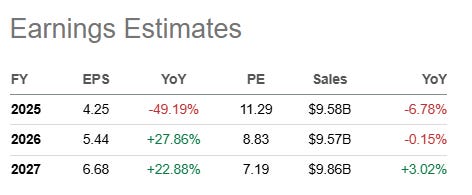

2025 estimate = $4.25

The financials show a company that consistently makes money on an adjusted basis. If we throw out 2021 and 2025 as the outlier good and bad years, we have average earnings of $9 to $10 per share. Historically, Celanese has traded around 10-12 times earnings.

So will CE get back to earning $9-$10 per share? It may take some time, but I think it’s very possible (which I will explain in section #2).

Consensus analyst estimates project around $5.50 in EPS for 2026, and almost $7 EPS for 2027. I think these projections are understated because sell side analysts often think linearly and do not take into account the exponential moves up or down that exist in cyclical industries like chemicals.

Source: Seeking Alpha

But let’s take the $7 in earnings per share estimate as being accurate, and apply the 10-12 historical P/E ratio. We would get a target price of $70-$85 in this very pessimistic scenario.

If we use the $9-$10 historical average as a base case scenario, we would arrive at a base case target price of $90-$120. This would represent a double from the current stock price around $50 per share.

Considering free cash flow (rather than earnings), we see Celanese is projected to generate $700-$800M in free cash flow in 2025 despite a weak demand environment. The firm generated free cash flow of more than $1.3B as recently as 2023.

If the company can hit the mid-point of ~$1B in free cash flow on a normalized basis, and we assume a conservative 12x multiple (implied ~8% free cash flow yield), this would get us to a $12B market cap.

Dividing by ~109M shares outstanding gets us to a target price of ~$110 per share, so very similar to the P/E ratio analysis.

2. Why is the Market Wrong?

The market is worried about 3 main things on Celanese stock:

Chemical demand will remain at the recent anemic levels for the foreseeable future

Too much chemical production capacity will compress profit margins for the foreseeable future

Celanese took on too much debt acquiring the Dupoint M&M business and will encounter financial distress

Let’s address these points one by one to show that they are either mistaken or at least blown out of proportion.

Concern #1: Weak Demand

First, demand for CE’s products have been impacted by a slowdown in the global auto, housing, and industrial sectors as well as tariff-related uncertainty.

Fortunately the auto and housing sectors are projected to pick up growth in 2026 and 2027 thanks to lower interest rates in most of the major markets (especially the US).

Tariff related uncertainty still exists but have stabilized and supply chains rerouted. As such, I expect chemical imports/exports activity to also pick up in 2026 which will help unfreeze the global chemicals trade.

As long as we build houses, cars, and use various resins and plastics in our everyday lives, it is only a matter of time before demand for chemicals recover to match global GDP growth.

Concern #2: Excess Supply

Secondly, the prolonged downturn in the chemical sector has led to some capacity closures and mothballing in 2024-2025 which will only continue in 2026.

For example, industry leader LyondellBasell (LB) said it expects approximately 21 million tons of ethylene capacity to exit the market as a response to the downturn, with roughly 9.5 million tons already closed or announced.

Celanese is also doing its part to rationalize capacity, shutting down its acetate tow production facility in Belgium during the second half of 2026.

As this capacity exits hit the market, the supply/demand picture should improve, improving profitability for chemical producers such as Celanese.

High prices are the cure for high prices, and low prices are the cure for low prices.

Concern #3: High Debt Levels

Finally, while the market may be concerned about Celanese’ high debt levels, I think this is an overblown concern.

In fact, the high starting leverage is actually a net positive in my mind to help juice returns as the company can successfully pay down & refinance its debt and “climb the wall of worry”.

Am I crazy to think in this way?

Well, let’s first look at the company’s overall debt position.

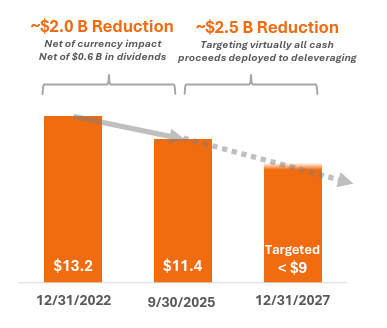

As of end of Q3 2025, Celanese had net debt of $11.4B. Much of this debt was accumulated during the aforementioned Dupont M&M acquisition in 2022.

Source: Celanese Q3 2025 Investor Presentation

In the past 12 months, management has:

Divested its Micromax business to generate ~$500M in cash to pay down debt

On track to generate $700-$800M in free cash flow in 2025, much of which will be used to pay down debt

Effectively retired the 5-year term loan due 2027 which was the biggest near-term debt concern, through paying down most of the balance via free cash flow, and refinancing the remaining amount in Dec 2025 by issuing longer-term debt due in 2031 and 2034

With 2026 free cash flow projected to be at least as high as 2025, and further opportunistic divestitures planned in 2026/2027 to further raise cash, I have no concerns that Celanese will have plenty of runway to recover without the debt causing imminent financial distress.

3. How will this Gap Close?

So how will we close the gap for Celanese between the current stock price around $50 and our target price of $90-$120 per share?

I think there are 2 main catalysts:

First will be chemical fundamentals improving, showing up in pricing and profit margins.

I anticipate improving end demand and continued chemical capacity rationalization to start tightening supply/demand balances.

This in turn should lift pricing for Celanese, and improve margins, allowing earnings to turn back towards the normalized $9-$10 per share per year levels.

We are starting to see signs that chemical fundamentals are improving, proxied by polyethylene prices. Notice the rebound in the past 1-2 months after hitting its nadir in December 2025.

Source: Trading Economics

The second catalyst is continued resolution of Celanese’ debt situation. As the firm continues to pay down its near-term debt and pushes out its average maturity date through long-term debt refinancing, I believe this overhang on the stock price should dissipate.

Management expects to pare down its net debt from $11.4B at end of Q3 2025 to less than $9B by end of 2027, and this goal should be easily achievable through free cash flow generation as well as another divestiture or two over the next 2 years.

4. When will the Stock Move?

Now that we have identified the price target, why the market is wrong (based on our variant perception) and catalysts to close the valuation gap, we can move into our technical analysis which will answer questions on timing.

Like many other names in the chemical sector, Celanese is approaching a breakout from its downward momentum.

As we can see from the 1-year chart, CE is now starting to remain above the 200 day moving average (DMA) after making several bottoms just below $40 during the past 12 months.

If CE can blast decisively past the 200 DMA by staying above $50+, this would confirm the technical breakout and indicate strong buying momentum.

Anecdotally, I’m starting to see CE and other chemical names mentioned by multiple astute Fintwit accounts I follow, and would not be surprised if some of these accounts are fund managers & large retail investors who are starting to accumulate shares.

This would explain the strong momentum we are currently seeing in CE.

TL;DR

Celanese is an undervalued chemical stock which has upside to more than double from its current price around $50 to our target price of $90-$120. The market’s pessimism regarding depressed end demand, excess capacity, and Celanese’ high debt levels are overblown.

As these concerns are put to rest over the next 12-24 months, I believe the valuation gap should close, rewarding intrepid investors who are willing to buy a volatile small-cap name at the bottom of the cycle.

Technicals are inflecting positively for Celanese as well, confirming our bullish fundamental view and demonstrating positive flows into the stock.

All in all, Celanese stock is one of my favorite opportunities in the market today as a classic deep value play inflecting from the bottom of the cycle.

Disclaimer: I currently own Celanese stock and add or sell more at any time. This is not investment advice, please do your own due diligence.

Really solid breakdown of the Celanese opportunity. The point about sell-side analysts thinking linearly rather than capturing cyclical inflections is spot on, I've seen this play out multiple times in chemical stocks. One thing that jumps out is the timing on teh M&M acquisition, even though it was pricey, having that scale could actually help them navigate capacity rationalization better than smaller players.