Let's Talk Mental Models

Sharing frameworks I use to "hack" identification of buy opportunities

I see a lot of mention of “mental models” on Twitter these days, which is just a fancy way of describing pattern recognition.

Through my 15+ years of investing in the market, both as a sell-side investment research analyst and then now as a private retail investor, I have developed several powerful patterns I can use to quickly screen out promising investment opportunities.

This investment “spider sense” that I’ve honed through many years of investing success & failure allows me to save a ton of time screening out stocks/industries to investigate, which can be overwhelming given that there are 8,000+ stocks trading across all US exchanges currently!

I can instead use this time saved up front to deep dive into the few stocks/industries that passes the mental model “test”.

By focusing on the “signals” that matter and tuning out the “noise”, investors can gain a tremendous edge over the masses who are following every twist and turn of the markets on CNBC which is ultimately noise in my view.

Let me share THREE simple patterns I’ve recently used to identify winning investment opportunities:

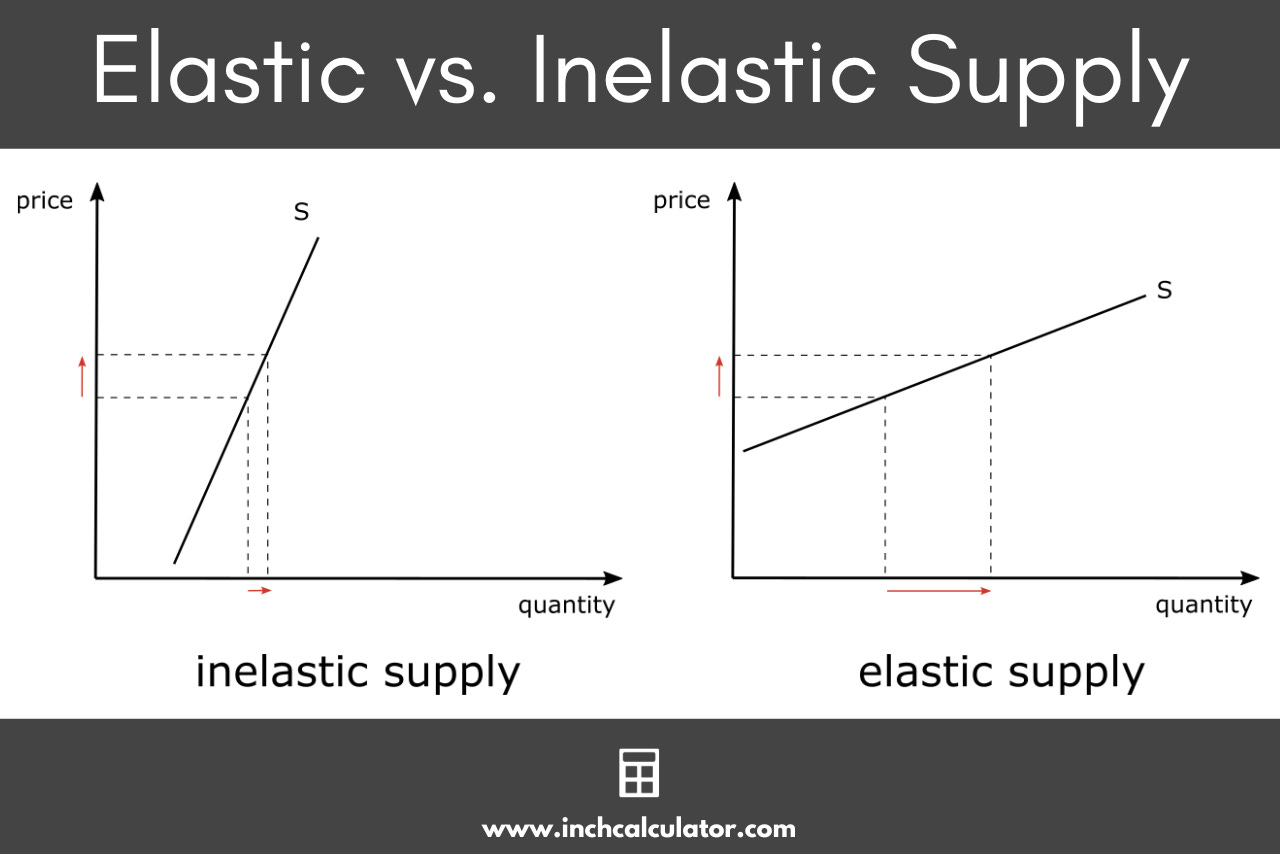

Demand Inflection in an Inelastic Supply Environment

It is no secret that I have been a huge proponent in recent years of many commodity-related sectors such as oil, coal, offshore drilling, and shipping (mostly tankers). The main reason I have confidence in my bullish thesis is that it fits my first major mental model of “Demand Inflection in an Inelastic Supply Environment”.

Inelasticity is an economic term that refers to the inability to easily change output (whether up or down) in response to external factors. For example, food demand is “inelastic” in the sense that you need certain amounts of food no matter how rich or poor you are.

In the industries I’ve referred to above, they are constrained by “inelastic supply” in that it is difficult to increase the amount supplied of oil, coal, offshore drilling rigs, and tankers even if demand rises significant, at least over the near time (next 12-36 months).

The specific drivers behind the supply inelasticity are nuanced for each industry, but is a combination of:

Geology constraints including tapping out of Tier 1 shale acreage

ESG constraints

NIMBY issues (“Not in My Backyard”)

Shareholder demands for returns over growth

Inability to easily obtain financing (often related to ESG issues)

Significant lead times to build major projects/assets even if financing can be secured

When you have demand that is inflecting upwards in an industry that exhibits inelastic supply constraints, you can see an exponential rise in profitability and re-rating of investment multiples.

While we have seen some of this dynamic play out in the last 12-24 months for oil, coal, offshore drilling, and tanker stocks, I believe as long as supply remains constrained there will be even better days to come.

Accelerated Buybacks to Force Re-Rating

While the first mental model I mentioned above is fairly easy to find, this second model of “Accelerated Buybacks to Force Re-Rating” is much more rare.

But when properly executed, the potential upside is enormous, and is fertile hunting ground for 10-baggers.

Consider Dillard’s (DDS). The company operates in a “dying” industry (i.e. malls), in Tier-2 or 3 locations with much lower foot traffic than “premium” mall players like Simon Property Group (SPG) or Macerich (MAC).

But look at DDS’s share price performance vs. SPG or MAC over the past 5 years:

Source: Seeking Alpha

DDS has easily trounced its “premium” peers over the past 5 years, and is up almost 15x from its Covid lows!

So how did a Tier-2 player in a dying industry accomplish such a feat? By buying back shares like there is no tomorrow to force a re-rating in the share price.

Take a look at DDS’ diluted shares outstanding count in chart below.

Source: Seeking Alpha

Management has shrunk its original diluted share count by more than 60% over the past decade!

What this aggressive and persistent buyback program has accomplished is to take away ownership of shares from investors who were willing to only assign dirt cheap multiples to the company (via buyback) and leaving shares in the hands of investors who have more generous view of the stock outlook and are willing to own at much higher & reasonable multiples.

Much like DDS, there is another company in the commodity space that is following a similar playbook which I wrote up for my paid subscribers.

Clearing Decks with Post-Bankruptcy Stocks

I have found post-bankruptcy stocks to be fertile ground for attractive investment opportunities in recent years, particularly in industries positioned favorably in terms of inflecting demand & inelastic supply as I described earlier in this post.

When done right, bankruptcy allows the company to “clear its decks” by discharging most of the debt and other liability that drove it into restructuring in the first place.

Secondly, post-bankruptcy stocks are often majority-owned by former creditors who received equity in exchange for taking a loss on their debt notes. These creditor-turned-shareholders are usually intently focused on making their money back through return of capital and will often push management towards these actions.

So think buybacks, dividends, asset sales, and even putting the company up for sale. All of these help unlock value for shareholders much more quickly than if these kinds of investors were not agitating for these types of corporate actions.

Third, when a stock emerges from bankruptcy, there is an initial period when many institutional investors cannot purchase shares because of investment mandates, lack of liquidity, or the fact that many post-BK stocks are not part of some major index initially.

This gives retail investors like you and me a brief window when we can take positions in these often undervalued stocks before the bigger fish can move in later once the post-BK stock has established a track record and been added to a major index like the Russell 2000 or S&P 500.

Some examples of recent post-BK stocks that have done quite well include:

Oasis / Chord Energy

Chesapeake Energy

Majority of offshore drilling stock (e.g. TDW, VAL, NE, DO)

In addition to these 3 mental models presented, there are many other shortcuts used by me & other investors that I did not have enough time to write about.

When used properly, these investment mental models can provide tremendous leverage in narrowing down the field of interesting stocks to conduct deep dives.

What are some mental models you use personally in investing or in life? Would love to hear about it in the comments section!

#1 is absolutely key. Focus on supply, not demand

Great stuff. Thanks for sharing