Two Truths and a Lie

Examining 2 previously recommended stocks that have outperformed, and seeing if one laggard deserves another chance

With the year drawing to a close with October around the corner, the trees are starting to show their foliage colors. Similarly, stocks I’ve recommended earlier in the year are starting to show their true colors.

For the majority of the stocks I’ve recommended, the results have been satisfactory to excellent. There are a few laggards also in the group. In this post I will examine 2 outperformers (“truths”) and 1 laggard (“lie”) to see the drivers behind their performance as well as future outlook.

Outperformer: RE/MAX Holdings (RMAX)

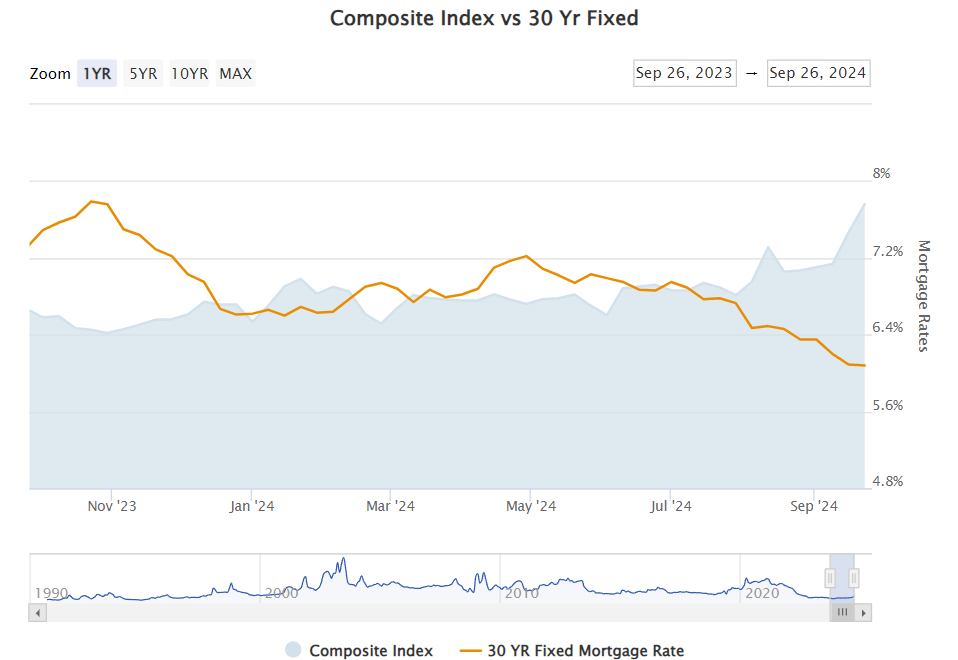

This pick was a straight forward story. High mortgage rates created a temporary (read: unsustainable) plunge in home transactions, which impacts real estate brokerages. As interest rates finally fell (as the Fed had been signaling), this is thawing the housing market, providing a boon for RMAX.

In the below chart, you can see that as the mortgage rates have ticked down in the last few months, the index of mortgage applications (which includes new purchases + refinancing) has shot up!

Source: Mortgage Bankers Association

With one of the strongest brands in the industry, an asset-light franchise business model, and a solid balance sheet, RMAX may not offer the highest upside among its peers but was certainly a no-brainer pick when I recommended it in March at under $8/share. FWIW, the stock is up a cool 60%+ in the last 6 months since I recommended it.

I think RMAX stock still has some upside left given my target price of $16/share (see original article for the valuation math) with additional upside if we see more big dips in mortgage rates. But given that the easy money has been made, I wouldn’t be a buyer of new shares today.

The big lesson I’ve learned from RMAX is that from famed trader Stanley Druckenmiller, who advised:

[You] have to visualize the situation 18 months from now, and whatever that is, that's where the price will be, not where it is today.

Outperformer: ZIM Shipping (ZIM)

Another outperformer that frankly exceeded my more modest expectations was ZIM, which I originally pitched as a short-term trade in February at $12/share. For the benefit of all subscribers, I’m pasting the excerpt on ZIM here since the original article is paywalled:

Purchased additional shares of ZIM (ZIM) at average cost around $12/share last week as the Red Sea conflict shows no sign of let-up, and ZIM is best positioned to take advantage of the temporary spike in charter rates unlike a long-term charterer like Maersk who released pessimistic 2024 guidance. Maersk’s downbeat guidance incidentally tanked stock price for all container shipping stocks including ZIM even thought it’s like comparing apples to oranges, providing the opportunity to scoop up some more shares. Please keep in mind ZIM is a hugely volatile stock and a near-term trade rather than a long-term hold.

While I had originally regarded ZIM as a short-term bounce-back play, the situation kept getting better and better for ZIM with continued Red Sea shipping disruptions, surge in container shipping rates into 2025, and a puzzling high short interest exceeding 20% of shares outstanding.

Given these dynamics, I am now expecting ZIM to earn more than its total market cap if we add up my forecasted 2024-2026 cumulative earnings, which would be bad news bears for the shorts.

I have trimmed some ZIM stock to take profits, but still hold the bulk of my shares. The key lesson here is to not be anchored to my original thinking, but be willing to be flexible as the situation changes. If I had traded ZIM for a 20-25% profit as I had originally planned, I would have missed out on the current almost double that it is today!

Source: Yahoo Finance

Laggard: Stellantis (STLA)

STLA has certainly been a sore spot in the portfolio. After surging over 50% since I recommended it last year, the stock crashed and gave back all of its gains plus some.

Talk about a rug pull!

Source: Yahoo Finance

So is STLA a value opportunity or a value trap?

The past 12 months have certainly been rough for the auto industry, especially for STLA. High inflation, slowing discretionary spending, and soaring interest rates (which negatively impact car loans/leases) took a bite out of sales for STLA, and increasing inventory of unsold cars compounded the worry.

The good news is that I see these factors reversing over the next 12 months, with lower rates increasing affordability, and continued pent-up demand for autos given the very low new car purchase levels compared to historical averages during the 2020-2024 period.

STLA has THE strongest balance sheet among major auto players with a net cash position, and trades at an absurdly low valuation at less than 4x earnings (2024 full year expectations). Its double digit free cash flow yield can comfortably sustain its 8% dividend yield, so you also get paid while waiting for the stock to turn around.

I remain long STLA shares and think it’s still a compelling value opportunity, although it has certainly been a bumpy ride.

Hey, have you considered bottom fishing on INTC? I'm looking into it.