Let's Talk Retail

How I approach investing in the retail sector, and a few interesting names to consider

For those who have followed me in the last few years, you know that my go-to sector has been energy, as I saw the tremendous opportunity in buying out-of-favor names that were left for dead precisely at an upwards inflection point in the investment cycle. And while I am certainly the most comfortable with energy names (oil / gas / coal), I also am not afraid to go where the value takes me.

Recently I have been taking a closer look at the retail sector, which have been crushed in the second half of 2022 and first half of 2023 due to a number of factors:

High interest rates & inflation taking a bite out of disposable income for consumers

Write-downs and working off inventory glut from the temporary excess retail spending in 2020 and 2021 (from increased online spend during Covid lockdowns + stimulus checks)

Negative growth and profit comps vs. the unsustainably high earnings period in 2021 due to factors mentioned above

Peak shipping costs in 2021-2022 working itself through higher-cost inventory and reflected in COGS from accounting standpoint

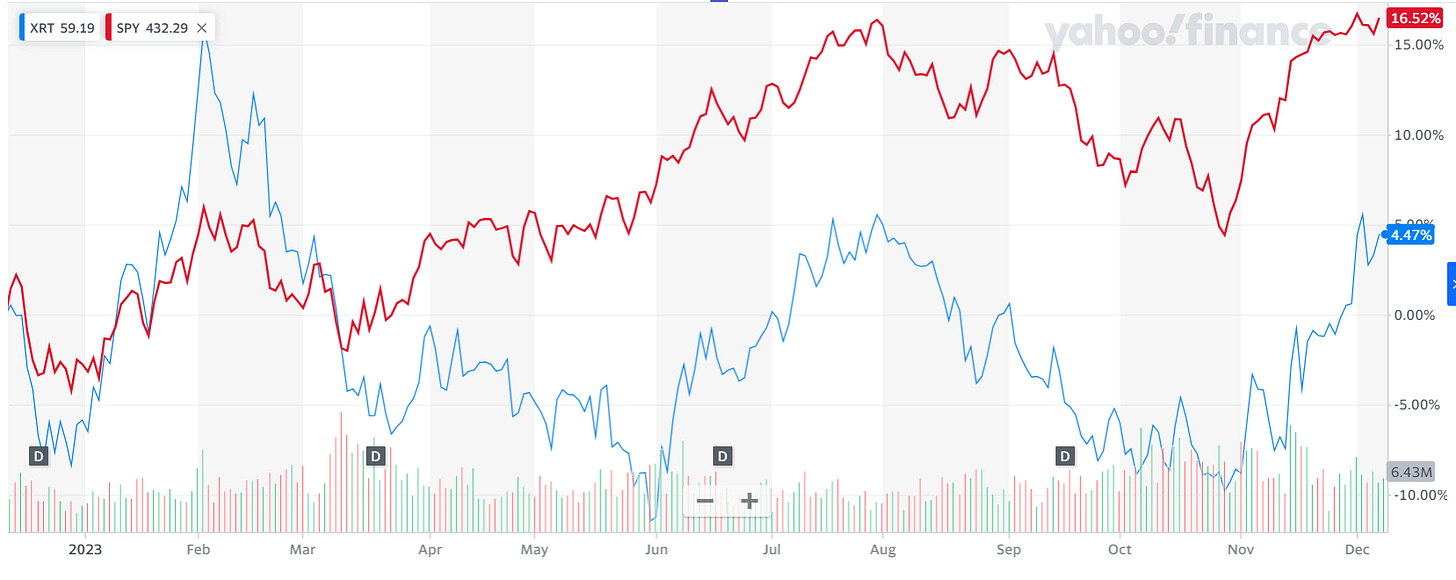

As a result of these drivers, the retail sector (proxied in chart below by the SPDR Retail ETF (XRT) has significantly underperformed the indices over the past 12 months, even with the significant gains since November.

Source: Yahoo Finance

I believe most of these headwinds are now either reversing to neutral or even flipping to tailwinds, presenting some attractive opportunities in the retail space for contrarian investors.

Unlike the energy sector, however, a rising tide does not lift all boats in retail as poor execution, fashion shifts, and secular downtrends can derail individual stocks even in an overall rising industry. All of this requires a more discerning eye in retail investing vs. focusing more on top-level supply/demand dynamics in the energy sector.

Here are a couple interesting retail names I have either invested in or am keeping on my watchlist, including one subscriber-only name from the Hidden Rock Capital model portfolio that I’m now opening up to all of my readers.

Children’s Place (PLCE)

Children’s Place is a contrarian retail opportunity I originally pitched to HRC subscribers in June of this year when the stock was trading under $17/share.

I will keep the full write-up reserved for subscribers (original writeup from June here), but the gist of the bull thesis is that PLCE’s 2022 and 2023 earnings were artificially depressed by high shipping & cotton costs, and as these headwinds subside, the company’s earnings would revert back to normalized levels, leading to significant stock price gains.

So far, it seems like the thesis is playing out, with the stock almost doubling from when I recommended the stock to subscribers (from under $17/share in June to over $31/share in August!). The stock has drifted down to the low $20’s, which is still 30%+ higher than when I recommended PLCE, as Q4 guidance was weaker than expected due to weak consumer spending.

I still believe normalized earnings power for PLCE is significantly higher than what the company generated over the past 2 years, and am holding onto the stock as a core holding in the Hidden Rock Capital Model Portfolio.

Academy Sports & Outdoors (ASO)

ASO is more of a “secular growth at a reasonable price” story, and I’m familiar with the company as a loyal customer. As a resident of Texas, youth sports is a huge phenomena, and at least in Texas and some of the surrounding states, the go to place to stock up for all of the youth sports needs is Academy Sports & Outdoors.

ASO has many of the features you want to see in a great retail company:

Great store economics

Long runway to be able to open up more stores given secular growth in youth sports in Texas & adjacent states

Sort of Amazon-proof since many of the sporting goods they sell are either too bulky to sell online effectively (think treadmills, basketball hoops), or parents/kids want to try on in store before purchasing to make sure it fits well, etc.

Management committed to returning capital to shareholders in the form of buybacks and dividends

Yet Another Value Blog has written a much more detailed post on ASO, which I encourage readers to check out.

The stock is trading for just 8x 2023 consensus earnings around $7/share, and this cheap valuation reflects concerns that the company experienced a one-time Covid bump from people spending on outdoor activities during the lockdown.

My view is that while 2021-22 was abnormally strong for outdoor retailers like ASO, and comps are certainly down in 2023 from the very strong 2022 figures, I think this is a temporary blip and Academy should continue to do well growing profitably over the medium to long term.

The company is strongly positioned from a brand & marketing standpoint in a regional niche market with strong secular growth. Youth sports has become an arms race among parents in suburban America, and I don’t see it slowing down anytime soon, benefitting suppliers like Academy.

Academy Sports & Outdoors is not part of the Hidden Rock Capital model portfolio yet, as I would want the valuation to become even more compelling before buying, but it’s definitely on the short list to watch.

Kohl’s (KSS)

Over the weekend, news broke that Arkhouse Management and Brigade Capital Management were making a bid for department store retailer Macy’s (M). Private equity and activist funds often play copycat, and of the remaining department stores in play, I think Kohl’s may be the most attractive player.

It was not too long ago (2022 in fact) when Kohl’s was fielding potential takeover offers in the $50 to $60/share range. Currently the stock is at $26/share and change after having fallen below $20/share just a few months back.

Kohl’s owns significant real estate, which is one of the major reasons that Macy’s received the takeover bid, and the company is well positioned for growth with its partnership with Sephora as well as more convenient locations in strip centers and power centers vs. the mall-focused format of its competitors.

Adding fuel to the fire is significant short interest at almost 25% which could spell trouble for shorts if a takeover offer is indeed received for Kohl’s.

Like with Academy, I am not ready to add Kohl’s yet to the Hidden Rock Capital Model portfolio before doing more due diligence, but it is on my short list to monitor.